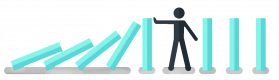

Building Resilience: Safety & Risk Management Systems Training Course

Audience:

- All Management Roles

- Accountable Managers, Safety or Risk Post Holders

- Prospective Managers seeking to enhance their risk and safety management skills

Overview:

This course provides an in-depth introduction to the key components of a modern risk management process through the development of a Safety Management System (SMS). It illustrates how these elements can be effectively utilized to manage risks within contemporary socio-technical systems. Establishing a robust SMS is becoming a widely adopted methodology for managing risks in complex and safety-critical environments. Participants will gain the skills necessary to build and adapt safety and risk management systems tailored to their specific areas of expertise. While the concept of SMS is not new, it is increasingly being mandated by regulations and accreditation schemes across high-performance industries. The course draws on frameworks from industries with high residual risks as benchmarks. Consultants with extensive practical experience will guide participants through a combination of theoretical and hands-on learning. Additionally, the course will explore the intersections between other management systems, such as Quality and Environmental Management.

By the end of this training, participants will be able to:

- Understand the foundational principles of safety management systems

- Identify strategies to mitigate risks associated with new and emerging technologies by applying SMS principles

- Develop a structured Safety and Risk Management System aligned with industry benchmarks

Format of the Course:

- Facilitated discussions and group interactions

- Scenario-based presentations, briefings, and accident analyses

- Breakout scenario workshops and group presentations

This course is designed to enhance the risk management capabilities of professionals for government and private sector applications.

This course is available as onsite live training in US Government or online live training.Course Outline

- Introduction.

- What is a Management System for Government?

- Why do I need a Safety Management System for Government?

- Components of an SMS for Government.

- Implementing Strategic Risk and Safety Management Processes for Government.

- How Does Risk Management Link to Operations for Government?

- Safety Feedback Mechanisms for Government.

- Training the Workforce and Effective Communication for Government.

- Summary and Conclusions.

Requirements

- A foundational knowledge of safety and risk management for government operations.

- Proven management experience in public sector environments.

Runs with a minimum of 4 + people. For 1-to-1 or private group training, request a quote.

Building Resilience: Safety & Risk Management Systems Training Course - Booking

Building Resilience: Safety & Risk Management Systems Training Course - Enquiry

Testimonials (3)

Practical examples

Mateusz Nowicki - BFF Polska S.A.

Course - Planning and Risk Assessment

The fact that all the standard was reviewed and discussed with some examples, when needed and required.

Ioana

Course - ISO/IEC 27005 Information Security Risk Management

Hakan was very enthusiastic and knowledgeable

Hugo Perez - DENS Solutions

Course - Project Risk Management

Upcoming Courses

Related Courses

Fixed Asset Management and Compliance

14 HoursFixed Assets Management and Control

14 HoursGovernance, Risk Management & Compliance (GRC) Fundamentals

21 HoursCourse Goal:

To ensure that an individual has a core understanding of GRC processes and capabilities, and the skills necessary to integrate governance, performance management, risk management, internal control, and compliance activities for government.

Overview:

- GRC Basic Terms and Definitions

- Principles of GRC

- Core Components, Practices, and Activities

- Relationship of GRC to Other Disciplines

Integrated Risk & Corporate Governance

35 HoursOverview

Regulatory bodies worldwide are increasingly aligning the level of risk taken by financial institutions with the amount of capital they must hold. Banks and other financial services organizations are adopting risk-based management practices to navigate this evolving landscape. The complexity of banking products, regulations, and global markets continues to grow, posing significant challenges for effective risk management. A critical lesson from recent banking crises is that risks are interconnected, necessitating a comprehensive understanding of these interactions to manage them efficiently.

Key features include:

- An explanation of current risk-based regulations

- A detailed review of the major risks faced by banks

- Best practices for adopting an enterprise-wide approach to integrating risk management across an entire organization

- Governance techniques to foster a culture where everyone actively participates in managing risks aligned with strategic objectives

- Potential future challenges for risk managers.

The course will utilize extensive case studies designed to explore, examine, and reinforce the concepts and ideas covered over the five days. Historical events at banks will be used throughout to highlight instances of failed risk management and actions that could have prevented losses.

Objectives

The objective of this course is to assist bank management in developing an appropriate integrated strategy for managing the complex and evolving risks and regulations in today’s international banking environment. Specifically, this course aims to provide senior-level management with an understanding of:

- Major risks within the financial industry and key international risk regulations

- Strategies for managing a bank’s assets and liabilities while maximizing returns

- The interplay between different types of risks and how banks can adopt an integrated approach to their management

- Corporate governance and best practices for balancing the diverse interests of stakeholders

- Methods for cultivating a culture of risk governance to minimize unnecessary risk-taking.

Who Should Attend This Seminar

This course is designed for individuals new to integrated risk management, senior management responsible for strategic risk management, or those looking to deepen their understanding of enterprise risk management. It will be beneficial to:

- Board-level bank management

- Senior managers

- Senior risk managers and analysts

- Senior directors and risk managers responsible for strategic risk management

- Internal auditors

- Regulatory and compliance personnel

- Treasury professionals

- Asset and liability managers and analysts

- Regulators and supervisory professionals

- Suppliers and consultants to banks and the risk management industry

- Corporate governance and risk governance managers.

This course is tailored to support professionals in enhancing their capabilities for government and private sector roles, ensuring they are well-equipped to address the multifaceted challenges of modern banking and financial services.

PECB ISO/IEC 27005 Foundation

14 HoursPlanning and Risk Assessment

14 HoursPlanning and Risk Assessment is a structured methodology designed to identify, evaluate, and mitigate potential risks in projects and operations for government agencies.

This instructor-led, live training (available online or on-site) is targeted at professionals ranging from beginner to intermediate levels who aim to enhance their skills in planning effectively and managing risks within projects or operational environments.

By the end of this training, participants will be able to:

- Comprehend the principles and processes essential for effective planning.

- Identify and assess potential risks across various scenarios.

- Develop and implement strategies to mitigate identified risks.

- Integrate risk assessment into the entire project lifecycle.

Format of the Course

- Interactive lectures and discussions.

- Group exercises and scenario-based practice sessions.

- Practical application through case studies.

Course Customization Options

- To request a customized training for government agencies, please contact us to arrange.

Project Risk Management

7 HoursProblem Solving with Root Cause Analysis (RCA)

14 HoursResult-Based Management (RBM)

35 HoursINTRODUCTION

The convergence of globalization, transformed markets, intense competition, and new technologies has intensified the focus on organizational management to ensure that every internal program and project achieves its intended results. Stakeholders are increasingly demanding effective management of both internal and external changes through programs that enable organizations to thrive in a dynamic environment. This seminar emphasizes the principles and practices of Results-Based Management (RBM) to hold departments accountable for their outcomes, aligning with public sector workflows, governance, and accountability.

This Results-Based Management training course equips staff and managers to align, develop, and review ongoing planning and reporting, which are essential for the success of any program, whether in the public or private sector. The seminar provides a comprehensive understanding of the processes needed to bring different business teams together to (a) better manage and measure the outcomes of their respective programs and projects; (b) maintain control over project execution; and (c) achieve stated objectives and goals.

This training course will highlight:

- The multiple processes involved in Results-Based Management (RBM)

- The critical role of monitoring in demonstrating program and project performance, and guiding the implementation process toward intended results

- Developing realistic program objectives and measures to assess project outcomes and impact

- Creating a results-based project framework

- Scheduling and reporting for projects and programs

- Monitoring, evaluating, and enhancing program effectiveness

OBJECTIVES

This training course is designed to achieve the following five key objectives. At the end of the session, participants will be able to:

- Apply current best practices in Results-Based Management (RBM)

- Demonstrate how to realize the potential of Results-Based Management (RBM)

- Design an RBM approach that involves all stakeholders

- Control RBM projects and measure outcomes effectively

- Enable teams to apply Results-Based Management (RBM) in their activities for government

TRAINING METHODOLOGY

The training seminar utilizes a variety of learning tools, including:

- Case studies on real-life examples of RBM implementation

- Round table discussion groups to review and evaluate ongoing or planned projects by group members

- Video references illustrating the skills necessary for achieving results

- Presentation media detailing the steps to achieve RBM

- Open discussions on ideas and experiences shared by participants

ORGANIZATIONAL IMPACT

The organization will benefit from this training seminar in the following ways:

- Enhanced understanding of the principles, norms, standards, processes, and responsibilities governing planning, monitoring, and evaluation

- Overcoming resistance to adopting Results-Based Management practices

- Developing more efficient methods for controlling costs and outcomes

- Ensuring staff members prioritize results in their ongoing planning and reporting documents

- Avoiding the pitfalls that can delay and burden project plans

PERSONAL IMPACT

Participants of this RBM training seminar will enjoy numerous personal and professional benefits, including:

- Focusing on issues that deliver maximum results in their ongoing planning and efforts

- Improving communication skills to gain stakeholder buy-in and leverage their influence

- Reducing the risks associated with long-term projects that could lead to disappointing results or failure

- Understanding the importance of monitoring and evaluation techniques for achieving successful outcomes

- Overcoming stakeholder resistance by providing solid evidence to secure funding

WHO SHOULD ATTEND?

The “Results-Based Management” course is designed to benefit experienced managers from any specialism within the organization who are responsible for the successful execution of programs and projects. It will develop high-level managerial skills that are essential for achieving and sustaining continuous performance improvement.

This training course will particularly benefit the following professionals:

- Strategic and Operational Planning Specialists

- Supply Chain and Logistics Team Members

- Financial Managers

- Marketing and Business Development Staff

- Human Resource Managers

Root Cause Analysis (RCA) for Internal Auditors

14 HoursRoot Cause Analysis (RCA) with Operational Safety Focus

14 HoursRisk Identification and Management Basics

7 HoursCourse Objectives:

- This one-day course will equip trainees/participants with the following skills and knowledge:

- Define what constitutes a risk, its origins, and its impact on business operations, enhancing their awareness of this critical topic.

- Cite various scenarios that can assist organizations in limiting and, where possible, eliminating risks.

- Conduct effective forecasting of potential risks and challenges in a proactive manner.

- Explore multiple techniques for identifying, mitigating, and minimizing risk.

- Collaborate with internal departments to reinforce comprehensive risk management strategies for the organization as a whole, ensuring alignment with public sector workflows and governance for government.

Risk management

14 HoursGovernance: Safety, Risk and Law

21 HoursAudience:

- All Management Roles.

- Accountable Managers, Safety or Risk Post Holders.

- Experienced Managers seeking to enhance their risk and safety management skills.

Overview:

This course examines the key factors influencing safety, risk, and potential corporate liability. These areas are of particular importance as they continue to evolve in the twenty-first century. The course employs a ‘systems thinking’ approach to manage complex systems effectively. The ongoing global pandemic has accelerated changes in various aspects of corporate strategy, and this course aims to address some of the main themes in contemporary management thought. We will explore how to mitigate emerging threats related to the digitalization of society. The curriculum includes high-profile case studies from diverse industries, which are analyzed and discussed collectively by participants. Cultural assessment techniques will be introduced and applied to real-world data. Participants will also undergo simulated cross-examinations by instructors to gain insight into what legal systems consider when assessing corporate liability in cases where risk mitigation has failed. This course equips participants with the confidence to make informed, risk-based decisions within complex operational environments.

By the end of this training, participants will be able to:

- Understand the principles of corporate criminal liability.

- Comprehend the nature of complex systems and strategies for managing them.

- Identify methods to mitigate the impact of new technologies on risk management.

- Strengthen the resilience of their risk management systems.

Format of the Course:

- Facilitated and group discussions.

- Scenario-based presentations, briefings, and case study analyses.

- Breakout scenario workshops and group presentations.

This course is designed to align with the needs of public sector professionals for government, ensuring that participants are well-prepared to handle the unique challenges they face in their roles.